You find yourself in the midst of a rapidly growing fintech company, where the pace is exhilarating and the ideas are bold. Your team is eager to enhance customer experience, but there’s a significant challenge—your current tech setup feels inadequate, like a small umbrella in a heavy rainstorm. That was our reality as we relied on a SaaS core banking application (CBA) that initially seemed like a good fit but soon became restrictive, like a pair of tight shoes.

We faced hurdles such as the inability to customise onboarding flows, slow response times for technical issues, and constant workarounds that only masked deeper problems.

After two years of operations, we realised we needed a tailor-made core banking application (CBA) to support our growth effectively. We sought a more flexible solution, which prompted us to embark on the journey of building Sprout from the ground up.

The development process kicked off in October 2021, and in 5 months, we proudly launched Sprout in March 2022.

Why We Built an In-House CBA

At Sycamore, we’re all about flexibility that controls the outcome. Our vision for Sprout went beyond just having control—it was about creating a platform that could match our pace and keep up with our goals for personalised, scalable financial products. Building our own CBA aligned with our ambitions and allowed us to create something entirely tailored to the needs of our customers. From smoother loan processing to more precise customer profiling, we finally had the freedom to shape every piece of the system to fit our unique vision.

Goals and Milestones

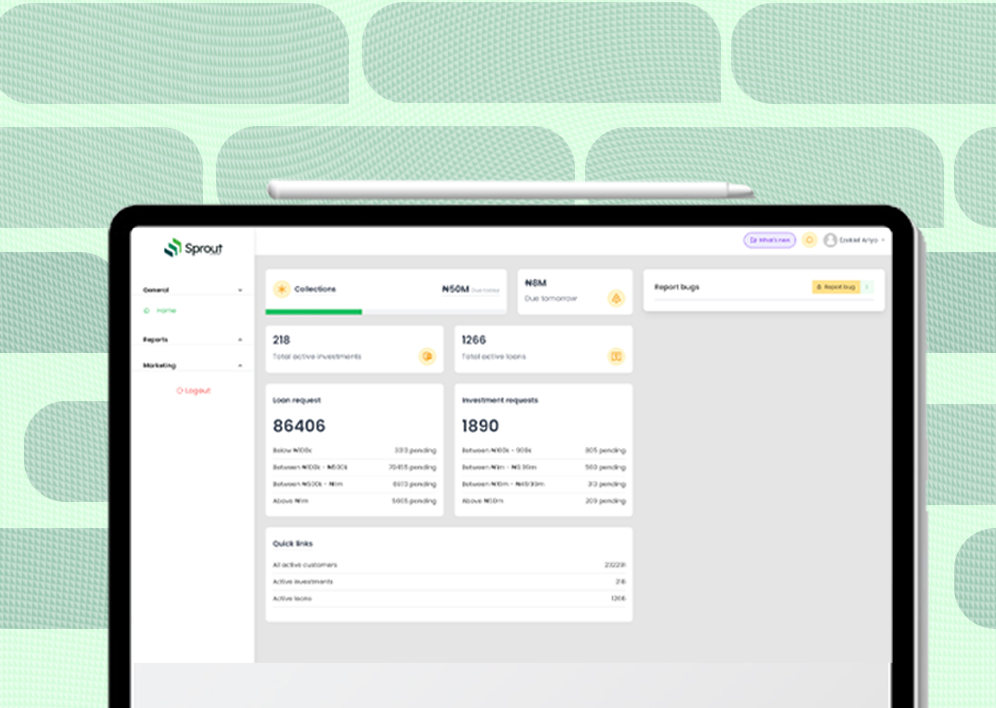

With the launch of Sprout, we had one big mission in mind: to make our processes as smooth and integrated as possible. We focused first on creating an end-to-end loan and investment management experience. This meant that our team could handle loans without interruptions and make quicker, more informed decisions. On the investment side, the new platform empowered us to manage portfolios with ease and accuracy, giving customers a data-driven, reliable support experience.

The Transition Journey: Challenges and Solutions

Moving from a SaaS CBA to a custom-built system wasn’t without its hurdles. Transferring large amounts of customer data took time, and to ensure accuracy, we brought in extra hands to manually oversee the migration. Getting staff comfortable with the new platform also took time. Training sessions and continual support were key to making the transition as smooth as possible, helping the team get accustomed to the more flexible system.

The Technical Backbone and Built-In Security

Sprout is structured on a microservices architecture, meaning that each function—loans, investments, customer management—runs independently yet integrates seamlessly. Built with a Vue.js front end and a Node.js back end, the platform is scalable and allows quick updates, so each part of our service can be independently optimized. On the security side, we put protocols in place that ensure data protection and limit sensitive data exposure, using third-party verifications to minimize data exposure. Real-time monitoring, access control, and detailed activity logs ensure that every action is secure and accounted for.

Built-In Flexibility for Scale and Innovation

Scalability was a primary goal for our new Sprout, which we designed with the capacity to grow:

- Optimized database queries to streamline data retrieval and reduce lag.

- Caching mechanisms that ensure faster access to frequently used data.

- Independent service scaling, so that each functional component can adapt to demand without affecting the whole system.

This structure not only supports a high volume of transactions but also maintains smooth performance across the platform. By decoupling services, we can handle surges in one area without dragging down the entire system. This is stability at its peak.

All-In-One Functionality for Financial Operations

Sprout integrates a suite of essential financial services that streamline internal operations and improve customer engagement:

- Lending: Facilitates full-cycle loan management, from application and risk assessment to disbursement.

- Customer Management: Provides our team with detailed customer profiles to enhance service personalization.

- Investment Management: Helps customers monitor and grow their portfolios with oversight tools for our investment team.

- Marketing and Communication: Delivers timely updates and targeted offers to customers within the platform.

- Internal Operations: Manages payroll and HR functions, consolidating internal and customer-facing operations within a single system.

Positive Impact on Customer and User Experience

Sprout also delivers major benefits across board:

- Increased Efficiency and Cost Savings: Our team now spends less time on workarounds and manual processes, freeing up resources for innovation. No more extra costs for third-party integrations, either.

- Customer Personalization: Customizable interfaces allow our support team to serve customers better, making every interaction smoother and more relatable.

- Enhanced Customer Engagement: With features like daily interest on wallet balances, we respond to customer feedback swiftly, rolling out updates that meet their needs and expectations.

Keeping Up with Our Customers’ Financial Goals

We’re already seeing high engagement rates and positive customer feedback thanks to the personalized, reliable service experience. Our platform’s 98% uptime rate speaks to the reliability of Sprout, and metrics continue to confirm that our tailored approach is paying off.

Future Enhancements

Our journey with Sprout is ongoing. We’re incorporating AI-powered analytics for better credit risk assessments, automating operations for further efficiency, and opening our API ecosystem to other fintech companies. By sharing access to features like wallet management and loan processing, we’re helping build a connected financial ecosystem (an evolution of real open banking), where innovation and collaboration create more value for everyone.

Sprout is a testament to Sycamore’s commitment to innovation, customer satisfaction, and growth. By leaving the limitations of an external SaaS provider behind and building a platform tailored to our strategic needs, we’re positioned to deliver a more personalized, efficient, and scalable banking experience.