When you hear the term “investment”, what’s the first thought you have? For many Nigerians, the first thing that’d probably come to their mind is buying a piece of land or less often, buying stocks. But there’s one option with high return rates and flexibility that is rarely considered as an investment option— peer-to-peer (P2P) lending.

In earlier times, when people wanted to get married, they requested the service of a matchmaker. The matchmaker acts as the middleman assessing the compatibility and needs and making introductions between two single people. However, since the advent of dating apps, that middleman has been cut out of the equation and people can now connect directly with their potential partners.

Peer-to-peer lending draws its parallel from this. Instead of relying on traditional banks to act as an intermediary between borrowers and lenders, both parties can connect directly through verified online platforms. This eliminates the need for these traditional financial institutions and can potentially result in lower interest rates for borrowers and higher returns for lenders.

What is peer-to-peer lending?

In the most basic terms, peer-to-peer lending involves individuals in need of loans getting funds directly from other individuals (investors) who have idle funds they can spare. With peer-to-peer lending, you no longer need to concern yourself with the complexities of stringent financial institutions like banks. With them (and their high fees) out of the way, P2P lending providers can offer higher returns to lenders while simultaneously allowing borrowers to loan money at a reduced rate. It is also known as crowd lending or social lending.

What does P2P lending bring to the table that traditional bank loans don’t?

First off, P2P lending is the table! Here are 3 irrefutable reasons why:

1. Accessibility: P2P platforms have a lower entry barrier compared to traditional banks, making it easier for individuals and businesses to access credit. Although, this isn’t to say that lenders are at higher risk when they loan money out.

“For instance, at Sycamore, every individual who applies for a loan is screened against the databases of registered credit bureaus. While it is important to empower people financially, it is just as important to ensure that the principal funds and the interest are returned to the investors (lenders). “

2. Faster Approval Times: Imagine your imported goods arrive earlier than scheduled while you’re running a bit low on the funds required to clear them. Approaching a bank for a loan, you’re told that you will get an update on your application in 7 days. Mind you, there is no guarantee that your loan will be approved. This just means that you end up acquiring unneeded demurrage.

Meanwhile, most P2P lending platforms often approve loans faster than traditional banks. This provides you with faster access to the funds you need when you need them.

3. Competitive Interest Rates: P2P lending platforms may offer more competitive and negotiable interest rates than traditional banks, especially when the individual has a good credit history.

4. Flexible Terms: One thing P2P platforms can boast of over traditional banks is flexibility when it comes to loan terms and options such as shorter loan periods and tailored loan repayment schedules.

“With Sycamore, you can take out a loan or invest your idle funds for as short as 3 months. Unlike traditional banks that impose a 12-month limit for loans.”

Is P2P lending a better option than traditional investment options? How?

Every investment has its own risks, advantages and disadvantages. What sets P2P lending apart is how flexible it is.

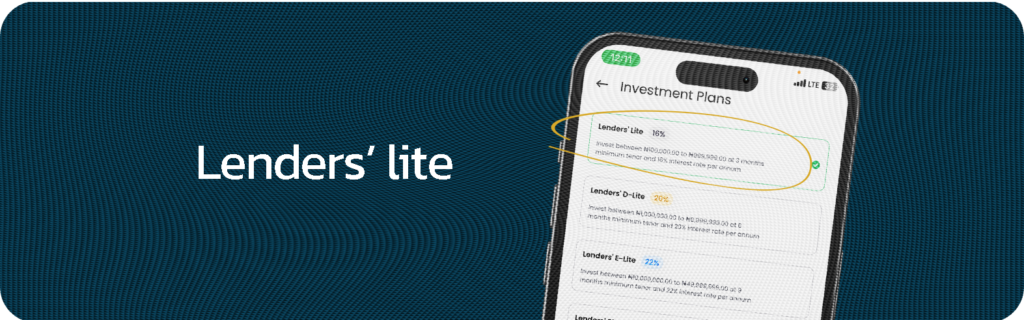

For instance, when you invest using the Sycamore app, you don’t need to wait till you have millions of naira in the bank. With just 100,000 naira, you can make a 3-month investment and acquire a 16% interest on it. With Sycamore, the flexibility goes further to offer tiered plans that increase in interest rates the higher the amount you invest.

Comparing this option with land investments where you may need up to 3 million naira for half a plot of land or the stock market that’s quite volatile, it’s clear to see that you stand to gain a lot more with P2P lending.

Tips for successful peer-to-peer lending

Peer-to-peer lending can be an advantageous investment option, but it’s vital to have a full scope of what it entails. Here are some tips for successful P2P lending:

Understand the risks:

Like with any investment option, P2P comes with its risks:

- Credit risks: Be aware that P2P lending comes with the risk of borrowers defaulting on their loans. This is why it’s important to use platforms like Sycamore that limit this possibility by thoroughly screening the borrowers and their credit history.

- Liquidity risk: Understand that it may not always be so easy to liquidify your P2P investments.

- Platform risk: Research the reputation and competence of any P2P platform you want to invest with. Use reputable platforms like Sycamore with a strong track record, transparent policies, and robust security measures.

1. Consider your risk appetite:

As discussed already, P2P lending involves some level of risk, so it’s important to understand your own risk tolerance.

2. Set realistic expectations:

Yes, P2P lending can offer higher returns than traditional investment options. However, it is important to set realistic expectations and thoroughly research the return rates your investment can fetch you per platform. With Sycamore, you can get up to 24% returns on your investment.

3. Monitor your investment:

Always keep track of how your investment is performing. The Sycamore app allows you to see how much you have invested and the total interest you have accrued at a glance.

Ready to invest and build wealth? Create a Sycamore account today and explore the limits of peer-to-peer lending.