Debt seems to have a negative connotation in Nigeria – generally speaking.. The media, both new and old, has been awash with stories of one indebted person or another, and how debt brought them to financial ruin. But debt doesn’t have to be a bad thing, because good debt exists. Debt that can serve as significant leverage, when properly used.

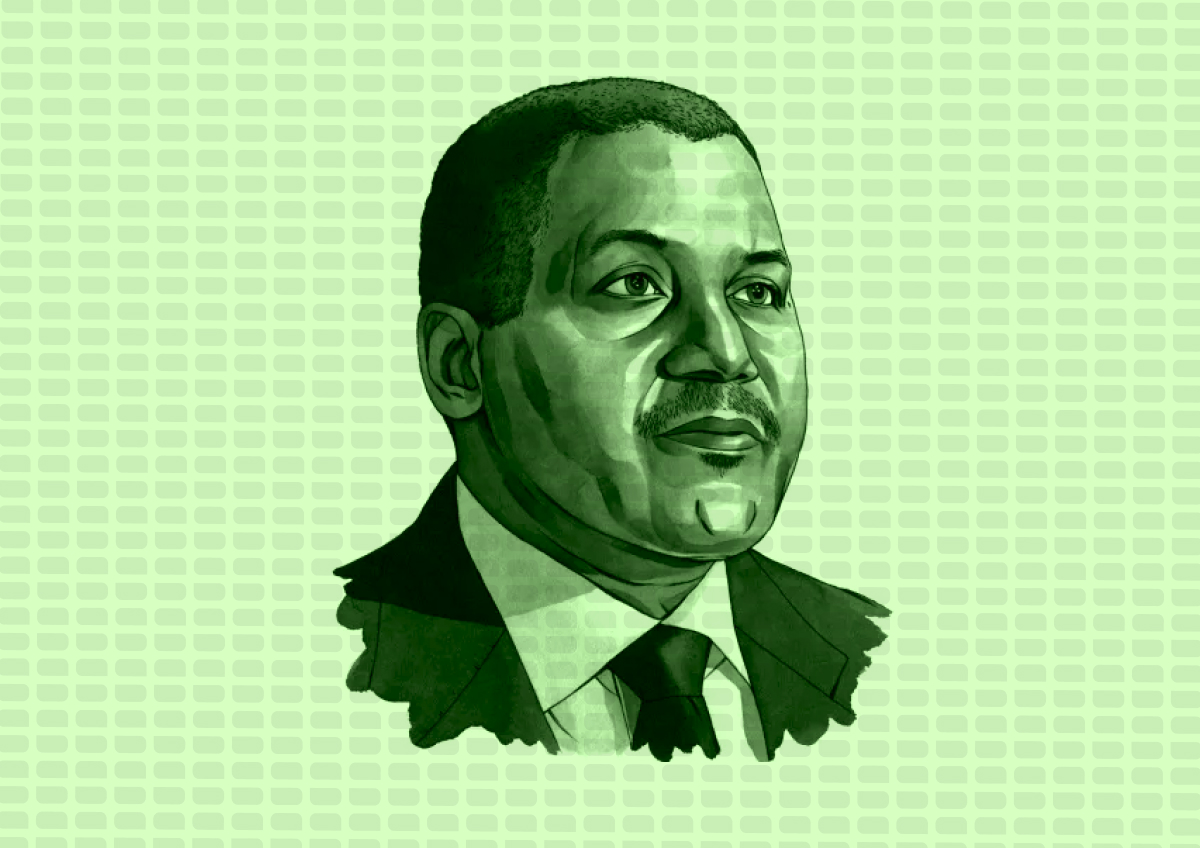

Nigeria’s richest man (and the richest black man), Aliko Dangote, has had a long history of using debt to his advantage. In fact a popular story claims that Mr. Dangote started out in the business world by borrowing some money from his uncle. With a huge grip on the building materials and consumer goods market, he recently completed the largest single train refinery in the world, a project which reportedly required around $9 billion in debt financing. Here are some lessons to be learned from his use of debt to achieve this:

1. Use debt to acquire productive assets

Reduce your borrowing on things that do not yield value in the future like expensive electronics , or the latest fashion in the market. To create wealth, you should focus on revenue generating investments. In Dangote’s example, it was claimed that the refinery was expected to generate up to $21 billion in revenue. That’s more than $2bn more than the amount that was invested, excluding its sale value.

2. Maintain a good credit score

The first time I heard “A Lannister always pays his debts” on Game of Thrones, I wanted to call the Lannisters and tell them to take all my money to do whatever they wanted to do with it. Even before operations, it was announced that Dangote had repaid over 70% of his debt. This makes him a better prospect for lending companies next time he’s looking for a loan. A great credit score makes it easier to access loans in future. Maybe it should be changed to “A Dangote always pays his debts”.

3. Create a clear cut plan

Know what you want to do and create a detailed plan. Also make contingencies for instances where the project might take longer or encounter hitches. The refinery encountered major roadblocks such as the Covid-19 outbreak. This caused the project to take longer to complete, and cost above two times more than was earmarked at first. He was more or less saved by his ability to raise more money from different sources.

4. Have a safety net

A safety net as the name suggests, is a plan put in place to soften your fall, if your business/main income goes awry. Dangote doesn’t own just a refinery, he also owns various companies operating in different industries. This gives his investors the confidence to lend him money, knowing that they can get at least most of their money back even if the business plan falls through. His safety net is also a great fall back for him to rebuild in the event that his business venture doesn’t go well.

While you might not have a whole industry giant as a safety net, you might have savings or even a side-gig just in case.

So there you have it. Dangote has proven to us that debt is not a bad thing, it just depends on how you use it, and how good you are at managing your debt to create sustainable wealth that you and generations after you can enjoy.

Looking for where to access a loan to begin working on steps to become the next Dangote? Check us out here. We’ll be sure to help you every step of the way.